Maintain Social Security’s Compact for All Taxpaying Americans

By Victoria Brenner, Legislative Analyst, and Leticia Miranda, Senior Policy Advisor, NCLR

As part of its mark-up of the comprehensive immigration reform proposal S. 744, the Senate Judiciary Committee has already considered 81 amendments. On Monday, when the committee reconvenes, it is slated to take up one that would be exceedingly harmful – amendment #24 offered by Sen. Orrin Hatch of Utah (Hatch #24), which denies lawfully present immigrants the Social Security benefits they earned through their work and payroll taxes. This is particularly unfair because hardworking immigrant taxpayers have contributed billions in payroll taxes to the Social Security Trust Fund, boosting its revenue and prolonging its solvency.

Why is this amendment so bad? First, reducing access to Social Security for Latino immigrant workers would push millions into poverty later in life. If aspiring citizens are denied credit for their past contributions, their benefits would be substantially reduced and many would fail to achieve sufficient credits to ever qualify for Social Security. Moreover, over four million Latino children of immigrants would be would be left without the protection of Social Security in case their working parent died or became disabled. There are also broader macroeconomic considerations.

Second, many undocumented workers already contribute to the Social Security Trust Fund through payroll taxes. In 2010, they paid approximately $13 billion, and have added $120 to $240 billion to the Trust Fund. This represents almost 11 percentof all Trust Fund assets and has added an extra six years of solvency to the program. If Hatch #24 passes, these contributions would fund other people’s benefits and never be credited to those who made these tax payments.

Second, many undocumented workers already contribute to the Social Security Trust Fund through payroll taxes. In 2010, they paid approximately $13 billion, and have added $120 to $240 billion to the Trust Fund. This represents almost 11 percentof all Trust Fund assets and has added an extra six years of solvency to the program. If Hatch #24 passes, these contributions would fund other people’s benefits and never be credited to those who made these tax payments.

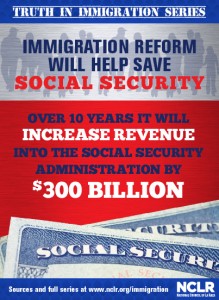

In addition to the contributions immigrants have already made, the Social Security Administration recently projected that S. 744, as presently written, will increase net revenue to Social Security by roughly $300 billion over ten years. Moreover, passing this bill would improve economic growth by 1.63 percent adding approximately 3.2 million jobs by the tenth year.

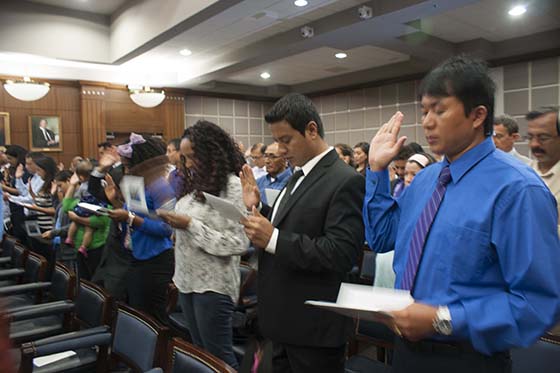

In light of the overall economic impact immigrants have on sustaining Social Security’s solvency, limiting their ability to draw from this foundational social insurance system seems particularly unfair. The program has operated since its inception under this compact: a lifetime of working and paying into the system, as many immigrants do presently, earns each worker their right to benefits later in life. Current law states that only workers who adjust to legalized status may correct their work history to claim credit for past contributions. Senator Hatch’s amendment, however, would bar immigrants who obtain such legal status from ever getting credit for their previous contributions.

This provision would also be difficult and costly to administer. To enforce this requirement, the Social Security Administration would have to verify the work authorization for every quarter of work history for anyone who is not a native-born U.S. citizen and who was issued a Social Security number after 2003. This requirement would apply to millions of legal immigrants and naturalized citizens in addition to those earning their legal status in the path outlined in S. 744. In an era of fiscal austerity, this does not seem like an overly appropriate use of scarce federal resources. Furthermore, as with all databases, mistakes are possible and even individuals who were never undocumented may wrongly lose coverage. Lastly, it is perhaps unprecedented or at least extremely unusual to distinguish between native-born U.S. citizens and naturalized U.S. citizens before the law.

Any immigration reform proposal must keep Social Security’s compact intact for aspiring citizens who have already contributed billions of dollars to Social Security’s Trust Fund. Anything less sets a dangerous precedent.