The Child Tax Credit: Taking care of families’ livelihoods and well-being

Either to pay for rent or for food, to treat our kids or to pay off debt, to save for college or to live a little bit more comfortably, hardworking parents all over the country are living the benefits of the Child Tax Credit (CTC). Today we bring you two of those stories.

By Beatriz Paniego-Béjar, Affiliate Communications Specialist, UnidosUS

Starting this July, families with kids younger than 18 who filed their taxes in 2019 or 2020, or who claim their stimulus checks last year, have been receiving the CTC, helping to reduce poverty across the nation.

If you haven’t received it yet, you will be able to claim it fully during next year’s tax season. You can learn more here in English y puede aprender más sobre este crédito tributario por hijos en español aquí.

PAYING BACK THE DEBT OF THE PANDEMIC

Sergio Vinicio Escobar Oajaca is a CTC beneficiary. A client and volunteer of UnidosUS Affiliate Canal Alliance, Sergio is a cook from Novato, California, who saw his work reduced during the pandemic. “I used to work in two restaurants: in one of them, they closed it and I didn’t get any more hours, and in the other one they only gave me a few hours. […] This year I haven’t worked liked I used to work before. Before I worked more, before the pandemic. Now with the pandemic, we’ve been working a little, and we are still not fully recovered, and so the CTC has helped me a lot.”

With four children in the house—Shalom (11), Sergio (8), Grace (5), and Gabriel Adair (two months old)—the family struggled to pay rent and put food on the table during the height of the pandemic. Sergio’s wife worked at a shop and she worked last year, but, as he explains, their kids were going to day care and as soon as there was a COVID-19 case, everyone in the house was quarantined for 14 days: “Last year, I had to be in quarantine four or five times,” Sergio explains, and only in one of those occasions he got paid for the 14 days; the rest of the time, he wasn’t paid.

However, Escobar could count on close friends to help him: “During the hardest times of the pandemic, sometimes I didn’t have the means to pay rent: I had to borrow money, reach out to friends to see who could lend me money. Sometimes my boss asked me: ‘Tell me how much you need, and I’ll lend it to you. We’ll straighten it up later.’ That’s how I survived.”

Receiving the CTC has allowed the Escobar family pay the debt they accumulated last year: “I’ve been able to pay back the consequences of the pandemic,” and thanks to it they are able to get back on their feet, while they continue to work to be able to feed their family.

TREATING HER KIDS

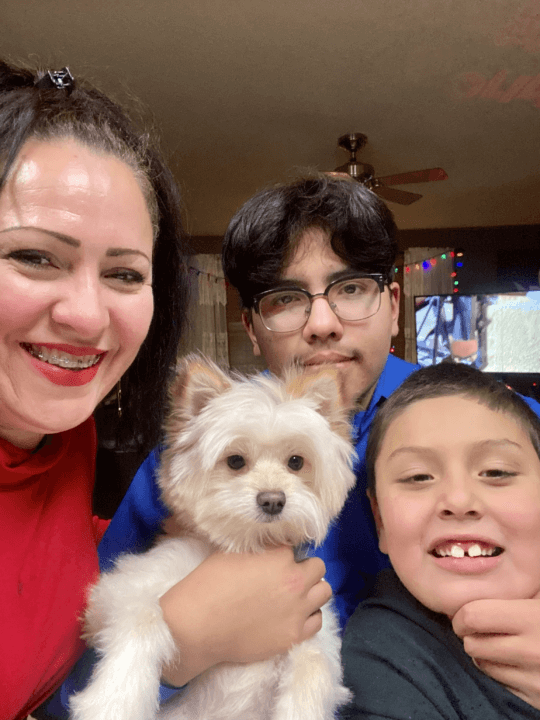

From California we go to Minnesota, where Carol Ríos, client of UnidosUS Affiliate CLUES, is also benefiting from receiving the CTC. Carol is a single mother of two (Daniel, 16, and Armando, eight-years old) who wants to be able to treat her children to new shoes, to ice cream, or to a vacation from time to time.

From California we go to Minnesota, where Carol Ríos, client of UnidosUS Affiliate CLUES, is also benefiting from receiving the CTC. Carol is a single mother of two (Daniel, 16, and Armando, eight-years old) who wants to be able to treat her children to new shoes, to ice cream, or to a vacation from time to time.

Seven and a half years ago, Carol set a goal for herself: she wanted to become a school bus driver. She knew the process was going to be challenging because of her English skills, but she persisted. “I had to take fours tests in English, and I know I don’t speak English perfectly, I don’t understand it perfectly, but I accomplished it,” she explains.

The same year she received her bus driving license, she also learned that her older son’s school was trying to fill a part-time position in the cafeteria, and that’s how Carol also became a “lunch lady,” like the school kids lovingly call her.

For more than seven years, Carol has been working hard at these two jobs, she pays her taxes, and she gets excited during tax season because she knows she’s going to receive the CTC. “The CTC is something that truly helps: it’s very necessary money,” she says. “When you receive that money is like a release, a break. […] It is something that is as beneficial for the children as much as for the parents.”

This single mother wants to ensure that her children have meaningful experiences they share together, and when she doesn’t need the credit to pay off debt or fix issues in the house, Carol loves to treat her kids: “I love going out with my children, to discover, to have fun. I want them to feel that I have been there, and that when I am not longer in this world, they can say: ‘Oh, my mommy took me here.’”

This single mother wants to ensure that her children have meaningful experiences they share together, and when she doesn’t need the credit to pay off debt or fix issues in the house, Carol loves to treat her kids: “I love going out with my children, to discover, to have fun. I want them to feel that I have been there, and that when I am not longer in this world, they can say: ‘Oh, my mommy took me here.’”

No matter where the Child Tax Credit is spent; these two hardworking parents are examples of how it benefits our families, their livelihoods and their well-being.

Visit GetCTC.org to find out more.

Para más información, visite GetCTC.org/es.