A father’s lesson on legacy

By Pedro J. Rivera, Esq., Senior Director for Individual Giving, UnidosUS

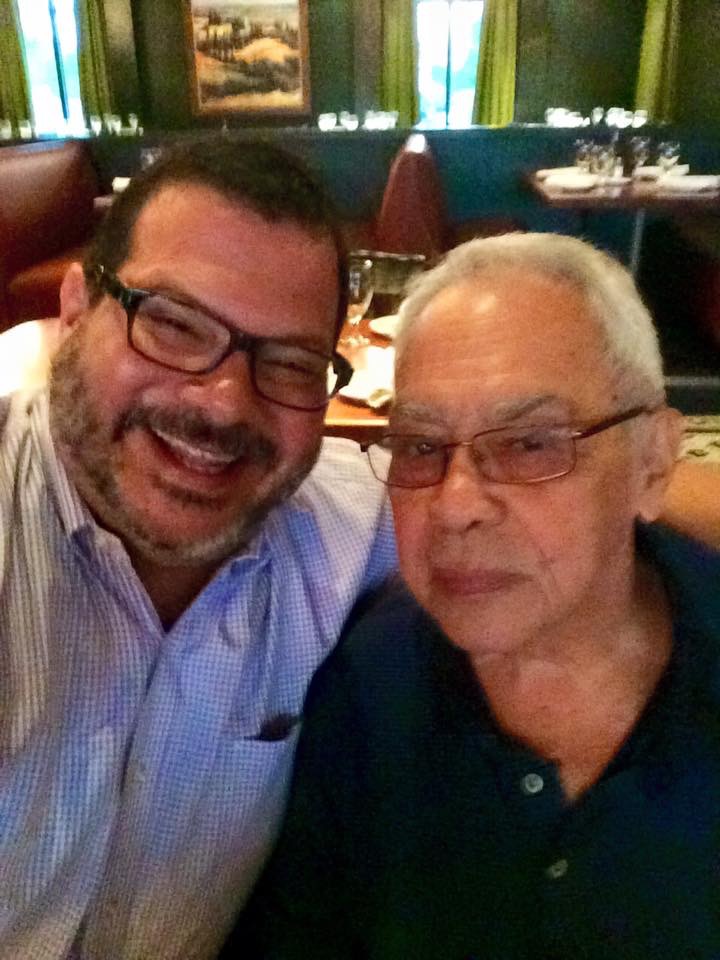

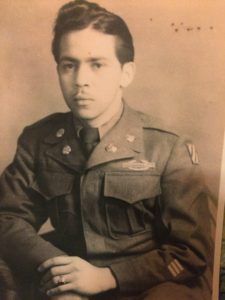

My father, a Korean War Veteran and a member of the 65th Infantry, a Puerto Rican regiment of the United States Army, was always grateful to organizations that helped veterans. He was born in Cayey, Puerto Rico, and was raised on a farm by his maternal grandfather. As a child, I remember him being involved in fundraisers for our parish or our sports team. He was blessed and reminded us that we must help those less fortunate than ourselves. Giving is an act of generosity. He would tell us, “en la vida hay que dar para recibir” (in life, you must give to receive). He was one of my earliest examples of donating to causes you care about. At the end of each year, I would see him make his donations to the Disabled American Veterans (DAV), an organization that helped many former soldiers just like him.

My background in financial planning assisted him in deciding to create his estate. He knew that I had helped many others make their estates and leave a legacy behind. When the time came to prepare for the future and think about the gift he wanted to leave, one that recognized the people and the organizations important in his life, we discussed the many ways to create an estate plan. Whether it was an outright gift or a deferred gift, I provided him the choices he needed to know to make his ultimate and most significant gift. In this way, his values and his legacy remain alive.

Defining your legacy can be an opportunity to “paint” the way you will be remembered in years to come. As an UnidosUS donor, you support our mission to build a stronger America by breaking down barriers and creating opportunities for Latinos. You are at a stage in your life, enabling you to make your most impactful gift to an organization that shares your values. Is that part of your lasting legacy?

Right now, there are many more opportunities for financial creativity than we have seen in recent years. It’s easy to create a thoughtful and caring estate plan that will make a lasting, meaningful difference where it’s essential to you. Depending on what you want to accomplish, you can transfer assets to:

- Provide for loved ones

- Continue support of your favorite philanthropies

- Reduce taxes for you or your heirs

- Simplify the transfer of assets

- Communicate your values

Here is an overview of two specific estate planning tools:

- The Will

- The Will is the cornerstone of most estate plans. It is a document that establishes who is to receive assets and how much they are to receive. When you have a will, you remain in control of the distribution of your assets.

- When you pass on without a will or other means of transfer, the court takes over and makes decisions for you. If there is no will, no part of your estate will go to your church, your schools, or the charitable causes you favor.

- However, according to your wishes, there are easy ways to distribute assets, which do not involve wills and probate courts. Some can be set up easily just by signing beneficiary forms provided by your financial advisors or bankers.

- Beneficiary Designations

- Name a person or your favorite charitable cause as a beneficiary of an insurance policy or your retirement account.

I learned from my father that it’s never too early to think about your legacy. Whether you’re providing financial security, planning for your final wishes, supporting a cause you care about, or passing on traditions and values, an estate plan helps you leave behind an apparent legacy for your loved ones. I’d be happy to discuss developing such a plan to continue your impact and leave a legacy to benefit the Latino community.

*Pedro J. Rivera, Esq. is Sr. Director for Individual Giving at UnidosUS with 20 years of diverse experience in donor relations, wealth management, development/fundraising, financial planning, and planned giving. For more information on the UnidosUS Planned Giving program and how to join the inaugural group of the UnidosUS Impacto Society, contact Pedro at (202) 776-1757 or [email protected].