Three Key Findings on Hispanics with Debt in Collection: Results from CFPB’s Recent Survey

By Renato Rocha, Policy Analyst, Economic Policy Project, NCLR

Debt collection in the Latino community is a critical consumer protection issue for one of the nation’s largest and fastest-growing communities.

Latino families need access to affordable credit but have been historically excluded or discriminated from accessing safe financial products. The FDIC’s 2015 Survey of Unbanked and Underbanked households indicated that a result of this persistent economic injustice is that Latinos and other consumers who have been outside the financial mainstream are vulnerable to financial shocks, such as health-related expenses or job loss. Having been sidelined from affordable products, Latinos have little choice but to turn to more expensive credit to pay for their expenses. For example, 39 percent of Hispanic households used an alternative financial product (such as a payday loan) in 2015, compared to just 17 percent of White households.

At the same time, a staggering racial wealth gap impacts Latinos’ ability to pay their bills and secure long-term economic stability. Nationally, Latino household wealth is only eight cents on the dollar compared to White households. Such inequality in the access to affordable credit and opportunities to build wealth leads Latinos to accumulate debt at higher rates.

Despite having these insights into Latino debt accumulation, not much was known about Hispanic experiences in the debt collection process until the Consumer Financial Protection Bureau (CFPB) released findings from their Survey of Consumers Views on Debt last month. The survey results not only provide comprehensive, nationally representative data on consumers’ debt collection experiences, but also detail differences in collection experiences by consumers’ demographic characteristics.

As detailed in the CFPB’s report, the following are three key findings on Latinos’ debt collection experiences:

- About two-in-five (39 percent) Latino consumers with a credit record indicated that they had been contacted by at least one debt collector. Hispanic consumers were more likely than White consumers to report having been contacted about a collector (39 percent vs. 29 percent).

- Most Hispanic consumers (54 percent) contacted about debt reported having been contacted specifically about credit card debt. Latino consumers were also more likely than White consumers (44 percent) to report having been contacted about credit card debt.

- About half of Latinos who reported an issue in the debt in collection process disputed the debt in collection. Nearly half (48 percent) of Latinos contacted about a debt cited an issue (such as whether the debt was theirs or the amount owed was correct) and, of these consumers, 23 percent disputed their debt in collection. Among White consumers, 52 percent cited an issue with a debt and 28 percent disputed their debt in collection.

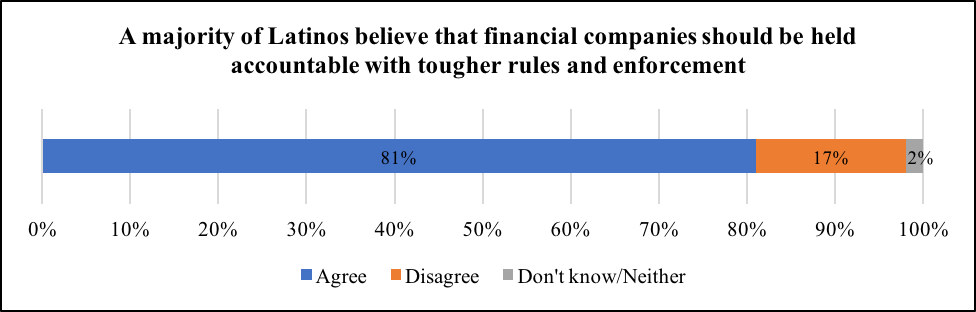

The CFPB has the power to help mitigate the financial distress of millions of American consumers, including Latinos. In the five years that the consumer agency has been collecting complaints, the Bureau has received about a quarter of a million complaints regarding debt collection practices, more than any other financial service or product. Promulgating strong debt collection regulations will be important to ensure that Latinos, and all consumers, are better served by the debt collection industry.