Latinos and Financial Freedom: NCLR Launches “Community Insights” Series

Many of the Latino community’s struggles recently have centered around economic stability in the wake of the Great Recession. The Hispanic community lost more than 66 percent of its wealth in the recession and has not yet recovered lost ground. In order to understand more about Latino households’ ongoing economic challenges and how they’re overcoming them, NCLR established a Financial Services Advisory Council with the support of Citi Community Development, the Ford Foundation, and Master Your Card: Oportunidad.

The Financial Services Advisory Council is composed of a group of 10 NCLR Affiliates who serve more than 40,000 clients annually and provide input on how their clients are interacting with financial institutions, what products and services are most useful to them, and how they are managing financial stress. Of the nearly 300 community-based organizations that make up the NCLR Affiliate Network, these 10 are economic first-responders in their communities and offer a range of financial counseling and capability services.

The Advisory Council provides insights into the trends they observe as community leaders and liaisons to the clients they serve daily. They also survey clients to gather direct feedback on the consumer experience with the financial services industry.

Keep up with the latest from UnidosUS

Sign up for the weekly UnidosUS Action Network newsletter delivered every Thursday.

NCLR plans to work with this Advisory Council throughout the year to explore issues related to financial products, tax refunds, savings, college affordability, homeownership, and intergenerational wealth.

Last fall, NCLR conducted its first survey with the Advisory Council and is publishing the results in a new series, Latino Community Insights. This series will inform and guide policymakers and financial institutions to ensure Latinos have access to quality financial products that serve them well. The first two installments of the series address financial access and inclusion generally and prepaid cards specifically. Highlights from the findings include:

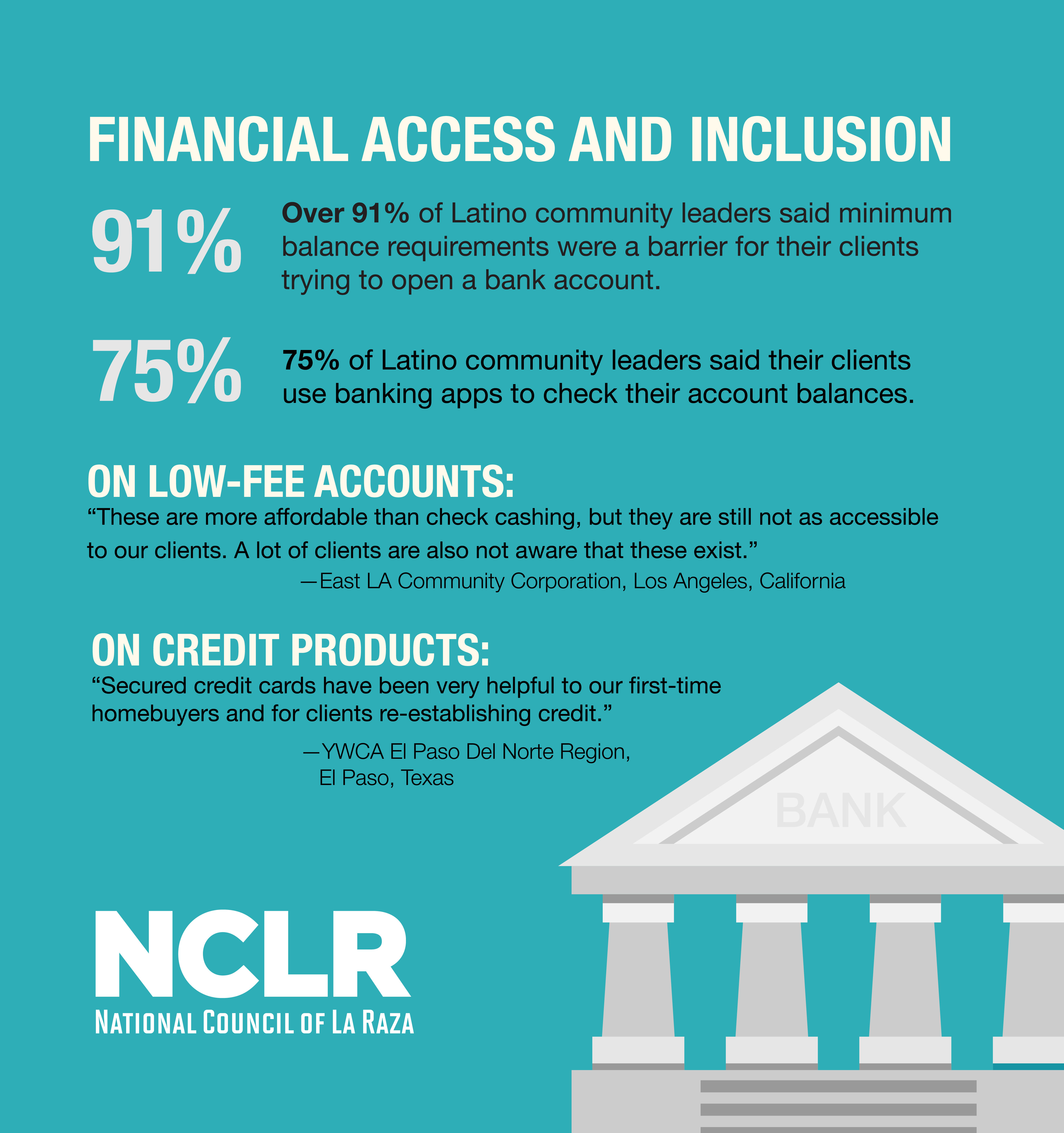

Financial Access and Inclusion

- Minimum balance requirements and high fees remain barriers for clients attempting to open a bank account. ATM and bank branch access are not barriers, as there is good coverage in the communities where the Advisory Council Affiliates are located.

- Low-fee “checkless” checking accounts are seen as a great option for low-income clients but are not well-known and can still be unaffordable for the very low-income.

- Advisory Council members see mobile banking technology as a helpful tool for their client and they observed many Latinos using mobile banking technology to check account balances and transfer money between accounts.

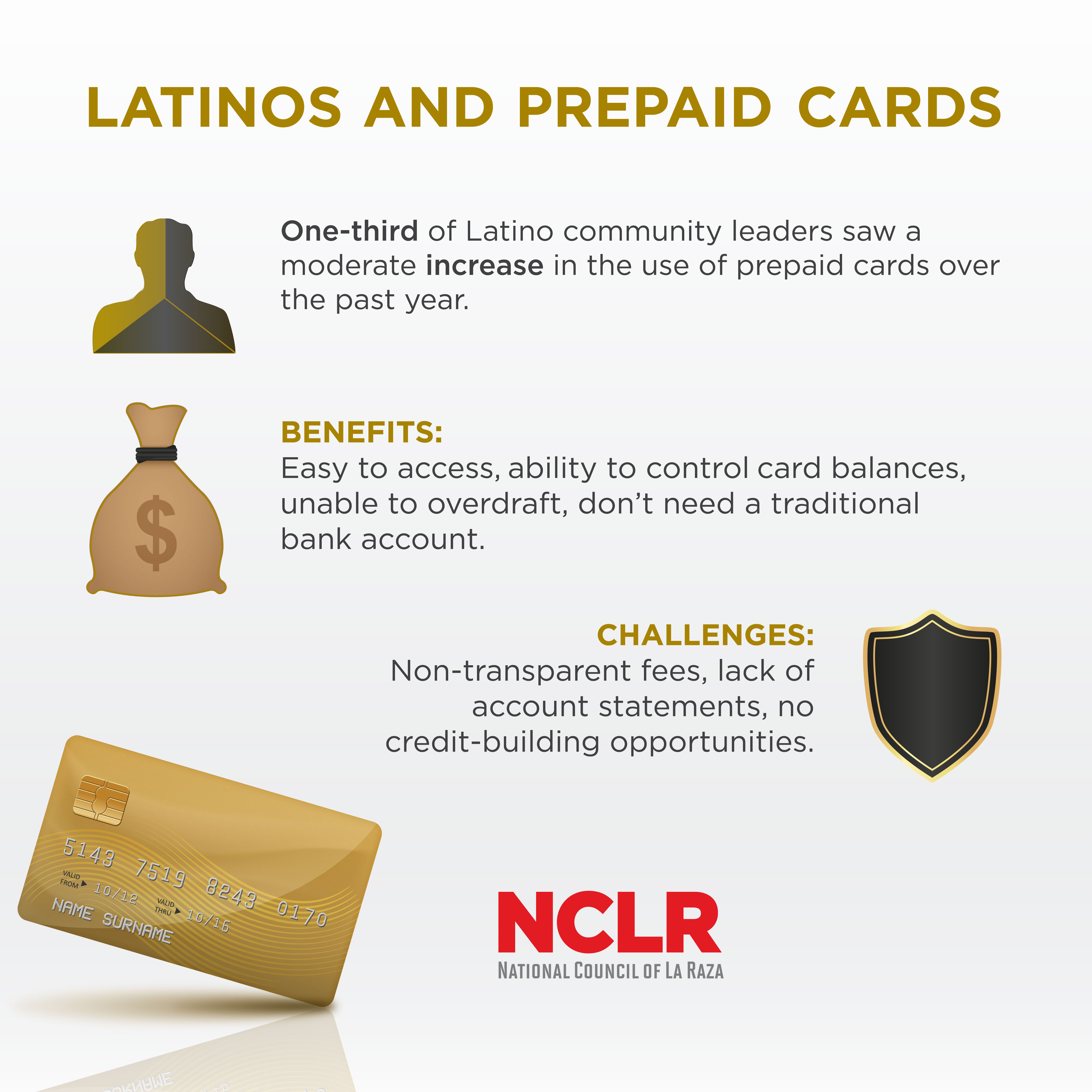

- One-third of Advisory Council members saw a marginal to significant increase in the use of prepaid cards over the last year.

- Prepaid cards are seen as a benefit to many consumers, especially those without a traditional banking account, for the inability to overdraft and the relative ease of use and access.

- Prepaid cards also come with some challenges, as often fees are high and opaque, account statements are hard to get, and there is no opportunity to build credit.

- Advisory Council members noted that reforms, like some being proposed by the Consumer Financial Protection Bureau, could help their clients take full advantage of prepaid cards: create transitions to credit-building products; provide clear information on fees in Spanish and English; educate consumers on how to avoid fees; and note the differences and potential limitations of a prepaid card versus a traditional bank account.

The Advisory Council represents a diverse group of organizations from across the country and their guidance on economic issues is critical to both the stability of their local communities and the country as a whole. NCLR will continue to work with the Advisory Council over the coming year to provide additional insights on issues around homeownership, student debt, and savings.

NCLR is grateful to the members of the Advisory Council for their contributions and looks forward to working with them this year: Teresa Palacios, Eastmont Community Center in Los Angeles, CA; Elba Schildcrout, East LA Community Corporation in Los Angeles, CA; Jan Marie Belle, SouthWest Improvement Council in Denver, CO; Joan Garcia and Franklin Monjarrez, CNC in Miami, FL; Julio Rodriguez, Northwest Side Housing Center in Chicago, IL; Veronica Villasenor, Brighton Park Neighborhood Council in Chicago, IL; Lowell Herschberger, Cypress Hills Local Development Corporation in Brooklyn, NY; Daniel Ruggiero, Homes on the Hill in Cleveland, OH; Carlos Garcia, Hacienda CDC in Portland, OR; and Patsy Flores, YWCA-Del Norte Region in El Paso, TX.